In Brief

Healthcare organizations are in the business of caring for patients, but to continue doing so your healthcare organization must be able to pay its bills. By optimizing core functions of your business, you can pay your bills today, invest in the future and continue to provide care to your community for years to come.

Set a Strategy and Stick to It

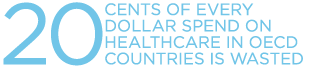

Approximately $750 billion is wasted annually within the healthcare industry. This accounts for nearly 30 percent of all healthcare spending. While unnecessary lab tests, supplies and other day-to-day expenses add up, in many cases organizations waste money because they haven’t aligned spending and the strategy around people, technology and/or acquisitions. To do so, create a strategic plan and then make sure that future investments align with this strategy. This ensures that your organization operates efficiently and allocates funding to areas of the business that will drive growth.

Align People and Purpose

- Align people to strategic goals. While organizations have invested significantly in one area, this may not be identified as a key area for growth in their strategic plan. For instance, if increasing outpatient surgery volume is part of the strategic plan, then backfilling nurses on the inpatient surgery unit may not be necessary. It’s also important to think about whether present staffing needs align to your long-term goals and, if they don’t, how to create a short-term staffing solution.

- Benchmark. To hire top talent, it’s critical that your organization’s compensation and benefits are competitive. Staffing should also match the marketplace to make sure that staff to patient ratios are also optimized.

- Align incentives. Healthcare systems are typically a conglomeration of hospitals, small systems and physician groups. As a result, the organizations often do not operate as a unified entity. This means that incentives vary across the system. Aligning incentives can help to standardize the cost of labor which may potentially reduce costs. This same principle should be applied to nonlabor expenses.

Evaluate Your Portfolio

Don’t try to be all things to all people. Instead, look at the services and products that are bringing in revenue and explore ways to continue growing that area of your business."

- Know the profitability of your service lines. Looking at revenue for each service line area rather than looking at the hospital’s overall revenue is critical to understanding an organization’s true financial state. This assessment can help to determine if resources are allocated appropriately and if the organization’s strategy for growth is generating revenue.

- Optimize products and service lines. Don’t try to be all things to all people. Instead, look at the services and products that are bringing in revenue and explore ways to continue growing that area of your business. Look at the business lines you want to grow, the technologies required to expand these areas and invest there rather than in areas that don’t tie back to the strategic plan. It’s also important to look at the risk of an investment as you identify new areas for growth.

- Divest non-core service lines. For services that aren’t generating a profit, assess whether you should stop providing that service. While it is possible to just end a service, carving it out can bring in cash that can be used to support your strategic plan. To make the most out of type of deal, it’s critical to conduct a valuation process to estimate the potential price/sales ratio.

More Effectively Manage Costs and Improve Revenue

- Invest in the right tools. Identify tools and technologies that will allow you to better measure and manage costs (labor, supplies, resource utilization, etc.) and revenue (coding/documentation, charge capture, denials, etc).

- Streamline and optimize processes. Analyze and improve processes for all major functions of the organization such as medication management, revenue cycle, supply chain distribution, care management and patient access.

- Optimize labor management. Focus on key labor management functions including productivity management, position control, daily staffing tools, skill mix, premium pay and compensation, and overtime.

Assess Your Financial Situation

Key Metrics to Consider:

- Revenue per discharge on a payor basis

- Labor cost per adjusted occupied bed

- Days cash on hand

- Operating cash flow

- Capital structure

- How much debt does the organization have?

- What type/duration is it?

- When does it mature?

- Capital expenditures (CapEx): Minimize it or maximize CapEx efficiency

By defining and focusing on a strategic plan for all financial decisions, healthcare organizations can reduce unnecessary expenditures, increase revenue, spend money on what matters and generate a profit. This allows you to optimize your core business and overcome the financial challenges from declining reimbursement, shrinking inpatient admissions and other industry pressures.