Using Analytics to Identify High- and Under-Performing Products

Banks are swimming — and, more often than not, drowning — in data. Only 13% of U.S. bank leaders feel their institutions effectively use data, according to a Bank Director survey. That said, most bank executives, particularly those of large banks with more than $5 billion in assets, believe data and analytics will soon play a more strategic role in their organizations.

Whether banks already rely on Oracle’s Financial Services Analytical Applications (OFSAA) or other solutions, a more effective approach to harnessing data can help banks better understand their real costs and profitability, both at the product and customer level. Achieving that goal, however, requires rethinking data practices across your organization.

Start With Strategy

Unfortunately, at many banks, data is siloed within various departments that do a poor job of sharing information across operational boundaries. The first step toward more effective analysis using your bank’s data is developing an enterprisewide plan, including strategic goals.

Whatever you’re trying to measure — be it organizational, product or relationship profitability — will ultimately inform the analytics tools and approach you use. Once clear objectives are in place, you need to determine what data you need, what data already exists, where that data resides and how to collect what is missing or incomplete. From there, define which metrics are most relevant for your organization to track.

It sounds simple, but it requires strong support from the C-level down. Finance, operations, marketing, IT, compliance — different areas of the business may claim ownership over different data, which sometimes leads to overlap and inconsistencies. When data is calculated, different parties with different agendas may disagree with the results and conduct their own analysis, leading to disparate and sometimes conflicting insights. Getting everyone’s buy-in on a disciplined and more centralized approach to data management and analysis is not easy, but it is a vital first step.

Most stakeholders within a financial institution have clear opinions about measuring profitability, making it that much more strenuous to unify everyone around a single methodology. To overcome internal friction, bank leaders should:

- Involve the right people early on. Including representatives from each business unit when outlining the requirements for your analytics program ensures everyone has a voice in the process.

- Consider revenue- and expense-sharing arrangements. Enforcing a model in which revenues and costs are allocated more equitably across the organization can make it easier to garner support for a central profitability methodology.

Understand Data Hierarchies

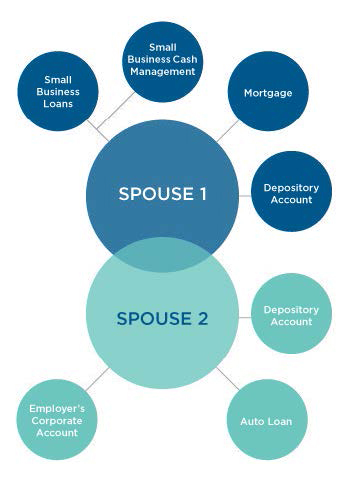

Is the data in your current financial and customer relationship management (CRM) systems integrated, providing visibility into the total value and profitability of that household’s relationship with the bank? Or would your relationship management personnel risk making ill-informed decisions based on incomplete information? Ensuring that data is tagged (and maintained) to reflect multiple hierarchical relationships will help front-line employees understand the complete value of a customer.

What to Analyze

Finally, determine what analyses will best help your bank. Areas ripe for data-driven analysis might include:

- Allocation costs: Are ledger-level costs being rolled up and allocated appropriately? Not all costs are obvious. For example, consider salary and benefit expenses associated with personnel not directly involved with your products. What about real estate costs? All overhead components should be analyzed and allocated appropriately.

- Pricing and risk: Similarly, are net interest margins and origination costs accurately tracked and reported? Can you assign a cost to risk and integrate that into profit calculations? How about capital attribution to enable risk-adjusted return on capital (RAROC) calculations? Only by accurately considering these issues can you generate a true idea of profitability at a product and customer level.

- Funding costs: Are you appropriately determining both the value and cost of each customer account, and balancing that against the cost of funds? Without a funding source, a bank can’t lend. But whether it is better to generate more deposits or to borrow on the open money market hinges on a precise understanding of the cost of gaining and maintaining those deposits.

- Regulatory compliance expenses: Effective compliance is essential, but it requires a significant and growing investment in both systems and personnel. Collect appropriate compliance cost data and map it back to its associated products and customers. This lets you better gauge the profitability of those products and guides decisions about which products and customers to retain in light of their compliance burden and related risks.

These are just some key issues, but there are many more to consider. Banks using OFSAA are already collecting a considerable amount of data — data they can leverage to better understand costs, profits and other key issues. Aligning your data practices, strategy and systems investment can help your bank make the right decisions more quickly.