In Brief

The current economic environment in financial services is characterized by market disruption, global competition, demand for actionable information, increased regulations and heightened pressure from shareholders. Successful navigation requires innovative thinking and an approach that combines modern technology and transformative organizational design. When these elements align, businesses are better positioned to respond with agility to changing market dynamics.

By innovating to enable a comprehensive view of the business, a digital-first approach to modernized business processes and data generation allows finance leaders to provide actionable insights that encourage agility in the face of a competitive market.

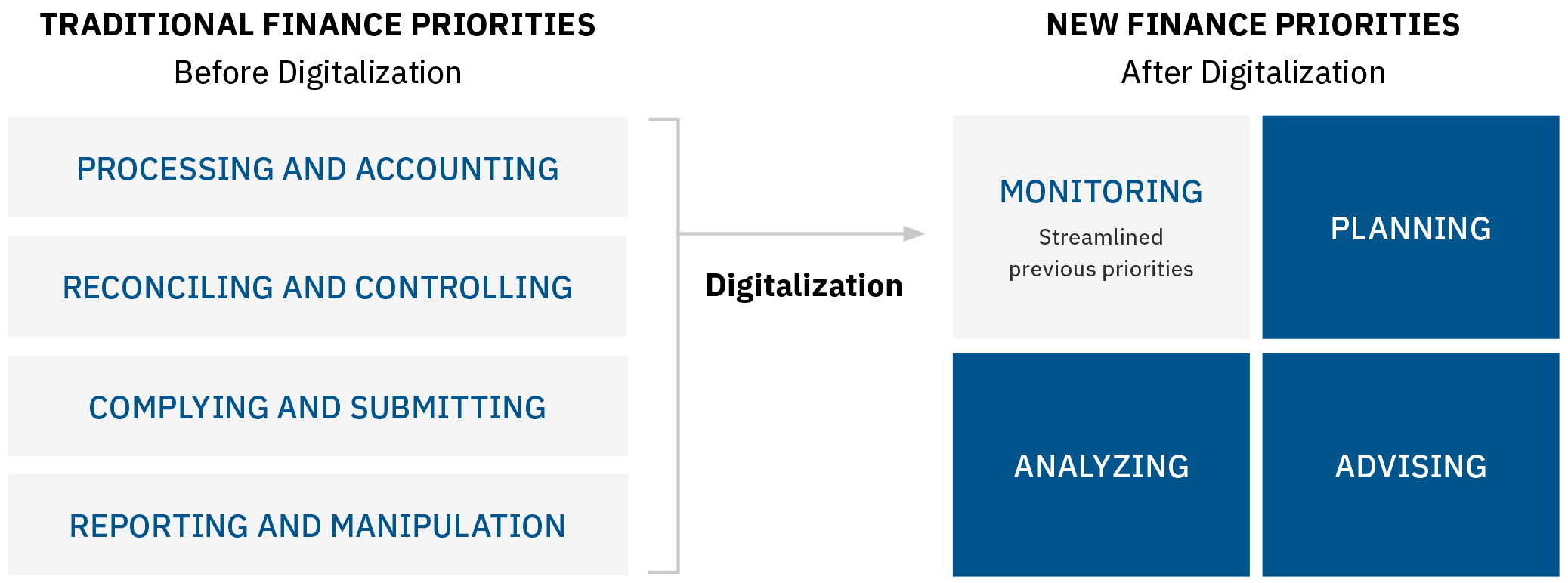

Over the past decade, finance has become increasingly advisory to the firm. This evolution will continue to expand in the future. The digitalization of finance powers this transformation. Finance has already begun to shift into a more strategic role within forward-thinking organizations. In the future, this trend will continue as finance professionals move further into internal consultant roles, provisioning information and deeper analytics through business intelligence and automation and using these insights to aid organizational decisions and strategy. In fact, the vast majority (as many as 90%, according to Gartner) of finance departments are expected to soon use robotic process automation (RPA) to manage many of the day-to-day activities that have defined the traditional back-office, accounting-based aspects of their jobs. Artificial intelligence, predictive analytics and machine learning are also key accelerators in this transformation. The result is a shift toward taking on new activities that are paramount to the future role of finance.

To successfully shift toward digital, finance professionals must evolve to take on more strategic, service-oriented roles focused on delivering actionable insights and decision support.

To successfully shift toward digital, finance professionals must evolve to take on more strategic, service-oriented roles focused on delivering actionable insights and decision support. This new finance landscape requires not only actionable insights but also a team that has exceptional analytical skills, who can interpret, respond to and drive decisions based on information sourced from across the organization and used to support informed decision making. When vital information is available and accessible on demand, finance professionals can reframe their value proposition to the business by aligning these insights to strategy and results.

Technology-Enabled Processes to Improve Functionality

Forward-thinking organizations are intentionally enabling connected holistic analytics that can be used to inform decision support and successfully execute organizational strategy. This synchronization requires out-of-the-box thinking and a technology platform that supports sustainable digital transformation and continuous business process evolution.

To provide the desired return on investment, the implementation of state-of-the-art financial technologies needs to be paired with process improvements that create frictionless workflows. Process digitalization requires a fundamental re-imagining of the organization’s existing technology stack through the lens of its alignment to desired future-state processes and enterprise analytics. At the same time, these new workflows need to be continuously optimized and evolving toward a frictionless end state that optimally delivers improved functionality and encourages enterprisewide standardization.

Digitalized business processes increase access to better, more consistent, validated and reconciled data. Contrasted with past methods of data harvesting in which individuals would be deeply involved in developing datasets and reports, automation (via updated technologies) makes the process of reviewing performance much more seamless, thus allowing financial services professionals to re-conceive how they spend their time.

To provide the desired return on investment, the implementation of state-of-the-art financial technologies should be paired with process improvements that modernize workflows to sync with updated systems.

When an organization’s finance platform becomes more sophisticated and friction is reduced or eliminated, the historical roles and functions filled by the department will become automated. Further, as high-quality data is produced more effectively and predictively, it pushes the focus of this department to more mission-driven pursuits. Implementing new technologies to produce useful data is only the first step. Using these insights to establish a strategy, inform business decisions and respond to market disruptions takes ongoing focus. Without a shift in the mission statement of the finance organization, data is just data. Staff must be trained effectively and supported consistently to embrace a digital-first mindset that promotes the business’s long-term goals.

Upskill Staff and Leaders to Embrace Digital Change

Digital transformation allows finance professionals to focus on higher-value activities more directly connected to the organization’s mission but can simultaneously create a significant skills gap for many existing leaders and staff. In fact, a 2019 Gartner survey found that 66% of finance leaders “believe the function’s digital competency gap is widening relative to the pace of evolving technology.”

The strategic competencies required by today’s finance organization are drastically different from those of the past — a fundamental change from reporting and analytics to value-added advisement. Talent that is strategically minded and digitally inclined will become the gold standard, and those who cannot or will not adapt will be left behind.

Organizations should also take an active role in helping existing staff members adapt to their new responsibilities by placing intentional focus on skills development. This programming should include training for:

- Effectively collaborating and communicating across the organization and relevant stakeholders (especially with IT and executive leadership).

- Digital translation (i.e., making data consumable and actionable to aid enterprise decision making).

- Linking financial acumen to organizational strategy and business priorities.

- Optimizing new technologies to support their new responsibilities.

- Leveraging automation and predictive tools.

- Managing wide-scale change at the individual and organizational level.

- Delivering exceptional, personalized customer service.

Talent that is strategically minded and digitally inclined will become the gold standard, and those who cannot or will not adapt will be left behind.

As finance talent models evolve to meet new digital demands, financial services organizations that do not actively direct the re-skilling of their workforces will experience competency gaps that inhibit long-term growth.

Modern workforces expect seamless experiences and state-of-the-art technology to support them. Corporate environments are no exception. When optimized, an integrated financial platform combined with enhanced processes allows businesses to deliver on demands for real-time data that supports enterprise decision making. Which, in turn, allows finance professionals to act as strategic partners rather than being relegated to back-office accounting functions. To make this shift sustainable, though, businesses must re-imagine their finance talent model and incorporate meaningful opportunities for staff to evolve their skill sets for the finance department of the future.

KEY TAKEAWAYS

-

Think differently.

Re-imagine the traditional finance department as a strategic business partner. -

Plan differently.

Integrate systems, update associated processes, and automate data reporting to modernize and automate key finance functions. -

Act differently.

Provide ongoing development opportunities for staff and leaders to enhance their skill sets in the more strategic finance department of the future.