In Brief

As part of the year-end planning process, one of the key questions financial services firms should be asking themselves is how can we improve the way our business is operating to optimally support our customers?

Once that question has been answered, leadership should focus on those areas that will help the organization react most quickly and strategically to the economy or the environment. As change accelerates, organizations that have embraced technological advancements and improved their business processes will be better positioned to react to the market, be responsive to their customers, and navigate regulations, in addition to improving their balance sheet.

To that end, Huron recently ran a poll on our LinkedIn page, asking financial services leaders in which of four areas they expected to allocate the highest percentage of their budgeted dollars in 2023. Choices included business process improvement, customer engagement, crime and fraud prevention, and technology advancements. After 186 responses, technology advancements and business process improvement tied (with 34% each) as the top area for budget allocation in 2023. Customer engagement came in second with 19% of the vote. And crime and fraud prevention followed closely at 12%.

In the following paragraphs, we’ll provide insights on the breakdown and give financial services leaders some guidance on how to get ahead in strategizing for 2023. Looking ahead to 2023, most experts agree that we are likely headed for some sort of recession or economic downturn. So, we posited that financial services leaders would be most concerned with activities and areas that would either positively impact their bottom line or help to reduce costs.

The Focus Areas

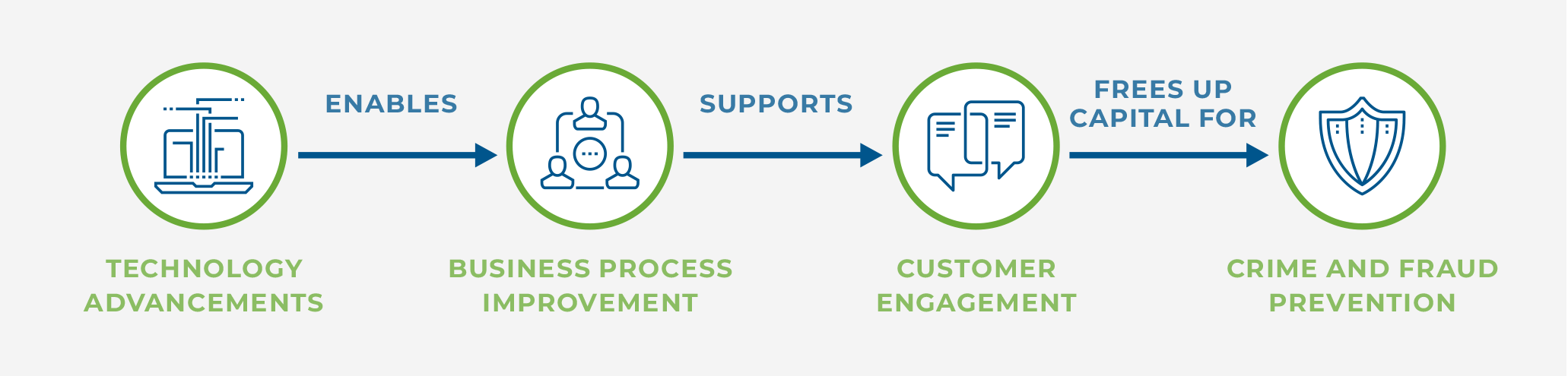

All four of the answer choices we provided in the poll are extremely critical to the success of financial services firms in the coming year. In fact, they all go hand in hand. You need one to be able to accomplish the other.

Financial services firms need to embrace technology advancements to enable business process improvement. When processes improve, they support customer engagement via better service, increased product alignment and marketability, and enhanced customer retention and loyalty. The addition of more customers, products, and services frees up capital to invest in crime and fraud prevention activities.

These four areas are foundational steps that lay the groundwork for better outcomes for all firms, regardless of the area of focus that is highest on your list of priorities. Whichever of these options you voted for (or would vote for), having a long-term plan for the other three areas is essential.

- Technology advancements: Digitalization is driving change across the industry. The investment in digital solutions, the modernization of current systems, and the integration of both ensures there are opportunities for advancement as your organization moves toward digital insights.

- Business process improvement: Business process improvement is an operational imperative for all organizations. Businesses that are not persistently improving the way they work to leverage new technologies and keep up with shifting consumer preferences, market dynamics, and talent acquisition and retention will be ill-equipped to compete against innovative peers and new market entrants.

- Customer engagement: Firms need to adjust their approaches to customer engagement to adopt an omnichannel presence that takes advantage of changing demographics, products, and channels. Having a robust framework and technology for customer capture and retention is a priority as customer loyalty can be short and as new nontraditional financial services players emerge and enter the market.

- Crime and fraud prevention: Financial crime and fraud will continue to dominate the marketplace and will be a major focus area in 2023. The best-positioned firms will require systems and processes that incorporate machine learning and artificial intelligence into their decisions for action. There will also be continued governance and additional regulations as crypto assets expand their use in the payments processes.

Planning for 2023

Business process improvement is an imperative for 2023. It comes in various forms and the need for it is substantiated by numerous factors: economics, strategy, technology, regulation, and changing customer demographics. Financial services organizations need to embrace continuous improvement as they progress toward a fully digital model and complete and robust digital insights.